Understanding Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of securities such as stocks, bonds, and other assets. Managed by professional fund managers, these funds aim to generate returns for their investors. The basic structure of a mutual fund involves the fund itself, the investors who provide the capital, and the fund manager who makes the investment decisions.

Mutual funds operate on a simple principle: economies of scale. By pooling resources, they can access a broader range of investments and achieve diversification that individual investors might find challenging to accomplish on their own. This diversification helps in spreading risk, as the performance of one security does not heavily impact the overall portfolio.

There are various types of mutual funds, each catering to different investment goals and risk appetites. Equity funds invest primarily in stocks and aim for capital appreciation, making them suitable for investors with a higher risk tolerance. Debt funds focus on fixed-income securities like bonds and are generally considered safer, offering regular income with lower risk. Hybrid funds combine both equity and debt instruments, providing a balanced approach to risk and return.

Investing in mutual funds offers several advantages. The professional management ensures that experts handle the investment decisions, potentially leading to better returns. The ease of diversification reduces the risk associated with individual securities. Additionally, mutual funds offer liquidity, allowing investors to buy or sell units with relative ease.

However, there are disadvantages to consider. Management fees and other expenses can eat into returns, especially in actively managed funds. Moreover, while diversification reduces risk, it does not eliminate it entirely. Market fluctuations can still affect the value of the investment. Lastly, past performance is not indicative of future results, and investors must be cautious and conduct thorough research before investing.

Assessing Your Financial Goals

When choosing the right mutual funds, it is imperative to align your investment choices with your individual financial goals. Financial goals can vary significantly from one person to another, ranging from retirement planning and wealth accumulation to funding children’s education and short-term objectives such as vacation or emergency funds. Identifying and clearly defining these goals is the foundational step in selecting mutual funds that best suit your needs.

For example, retirement planning typically requires a long-term investment horizon. In this case, mutual funds that focus on growth and have exposure to equities might be more suitable. These funds tend to offer higher returns over extended periods, which can be crucial for building a substantial retirement corpus. On the other hand, if your goal is wealth accumulation over a shorter duration, you might consider balanced funds or debt funds that offer a blend of safety and moderate returns.

Children’s education is another common financial goal. Depending on the age of your child and the time remaining until they need the funds, you might choose a mix of equity and debt funds. If you have a longer timeframe, equity funds can help grow your investment, while debt funds can provide more stability as the education expenses draw nearer.

Short-term goals, such as saving for a vacation or an emergency fund, generally necessitate a conservative approach. In such scenarios, liquid funds or ultra-short-term debt funds are often recommended due to their low-risk nature and better liquidity, ensuring that your capital is readily accessible when needed.

It is crucial to periodically review and adjust your mutual fund portfolio as your financial goals evolve. By clearly defining your financial objectives and understanding the time horizon and risk tolerance associated with each goal, you can make more informed decisions when selecting mutual funds, ultimately helping you achieve your financial aspirations.

Risk Tolerance and Investment Horizon

When selecting mutual funds, understanding your risk tolerance is paramount. Risk tolerance refers to an investor’s ability and willingness to endure market volatility and potential financial loss. It is influenced by factors such as financial situation, investment experience, and personal comfort with uncertainty. High-risk tolerance means an investor is more comfortable with potential ups and downs in the market, while a low-risk tolerance indicates a preference for stability and lower risk.

Mutual funds come in various risk levels. Equity funds, for instance, invest in stocks and are generally considered high-risk due to market fluctuations, yet they offer higher potential returns. On the other hand, bond funds invest in fixed-income securities and are typically viewed as lower-risk, providing more stable returns but usually lower than equity funds. Balanced funds, which invest in both stocks and bonds, aim to offer a moderate risk level by diversifying investments.

Investment horizon, or the length of time you plan to invest before needing access to your funds, is equally critical. A longer investment horizon allows investors to ride out market volatilities and can justify higher-risk investments, as there is more time to recover from potential losses. Conversely, a shorter investment horizon necessitates a more conservative approach, focusing on preserving capital and ensuring liquidity.

Aligning your investment horizon with your financial goals is essential. For instance, if you are saving for retirement 30 years away, a higher-risk equity fund might be suitable. However, if you are planning to buy a house in the next five years, a lower-risk bond fund may be more appropriate. By understanding your risk tolerance and aligning it with your investment horizon, you can make more informed decisions when selecting mutual funds, ensuring your investments are tailored to meet your financial objectives.

Researching Fund Performance

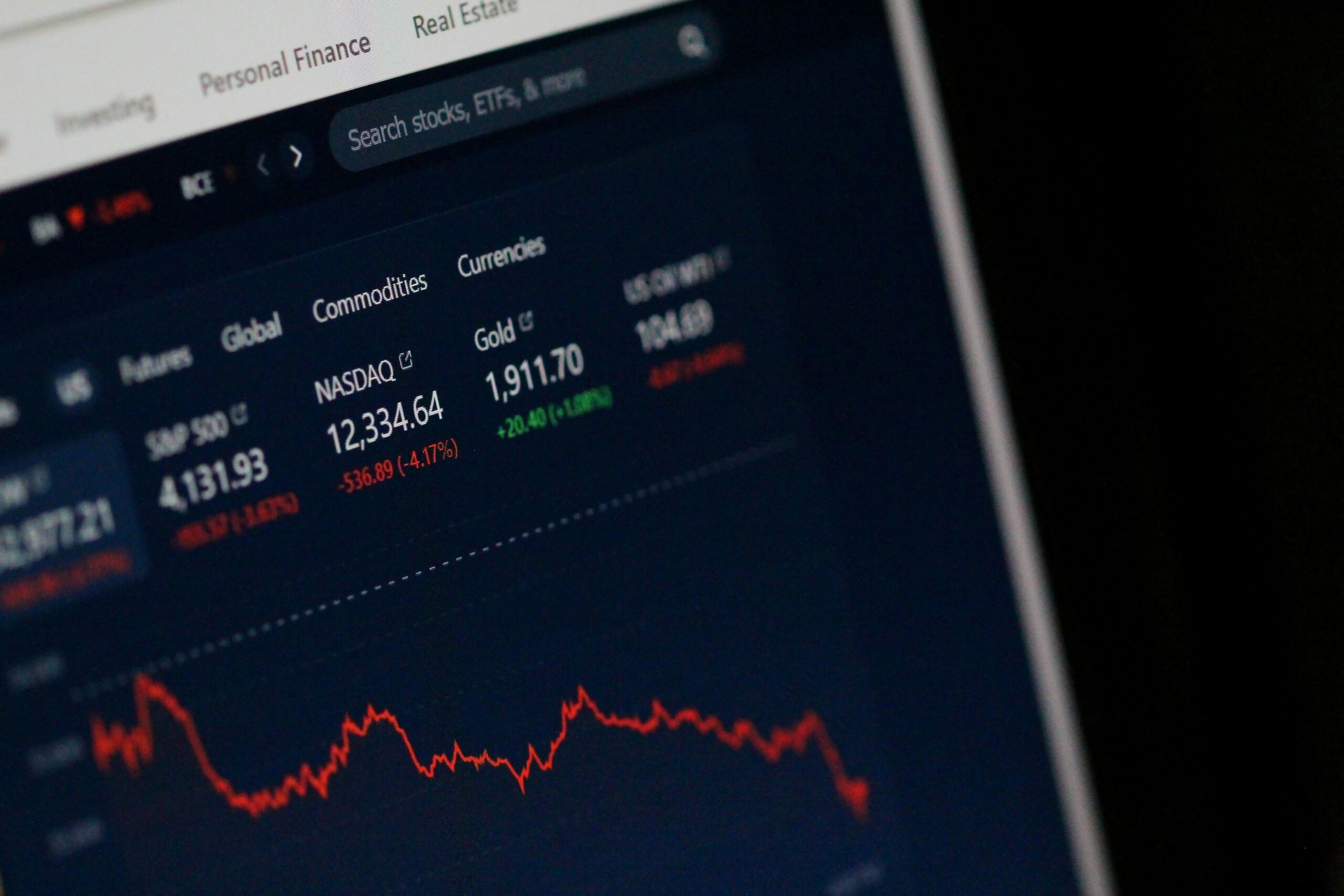

When evaluating mutual funds, one of the pivotal steps is researching fund performance. A thorough analysis of historical performance is essential. While past performance does not guarantee future results, it provides a snapshot of how the fund has navigated different market cycles. Look for consistency in returns over multiple periods—such as 1-year, 3-year, 5-year, and 10-year intervals—to gauge the fund’s resilience and ability to generate returns over time.

Another critical factor to consider is the expense ratio. This percentage reflects the costs associated with managing the fund, including administrative and operating fees. A higher expense ratio can erode returns, especially over the long term. Therefore, it’s generally advisable to favor funds with lower expense ratios, provided they meet other performance and management criteria.

The track record of the fund manager is equally important. A seasoned manager with a history of strong performance can be a valuable asset. Investigate how long the current manager has been overseeing the fund and review their performance across different market conditions. A manager’s expertise and strategy can significantly influence a fund’s success.

Fund ratings from reputable agencies like Morningstar can offer additional insights. These ratings often consider a variety of factors, including historical performance, expense ratios, and management quality, to provide a comprehensive assessment. High-rated funds are generally more reliable, although it is still essential to conduct your own research.

Interpreting performance metrics requires understanding key indicators such as the Sharpe ratio, which measures risk-adjusted returns, and the alpha, which indicates whether a fund has performed better or worse than its benchmark index. Comparing these metrics across funds within the same category can help identify which funds are outperforming their peers.

In summary, researching fund performance involves a multi-faceted approach, including an evaluation of historical returns, expense ratios, fund manager track records, and fund ratings. By carefully analyzing these factors and comparing funds within the same category, investors can make more informed decisions to align with their financial goals.

Analyzing Fund Portfolios

When selecting the right mutual funds, analyzing the fund portfolio is a crucial step. The portfolio reveals a fund’s asset allocation, providing insights into the proportion of investments across various asset classes such as equities, bonds, and cash equivalents. Evaluating the asset allocation helps investors understand the fund’s risk profile and suitability for their investment goals.

Sector allocation is another critical aspect to consider. This involves examining the distribution of investments across different sectors of the economy, such as technology, healthcare, financial services, and industrials. A well-diversified sector allocation can mitigate risks associated with sector-specific downturns and enhance the potential for stable returns.

Top holdings provide a snapshot of the fund’s largest investments, typically its top ten securities. Reviewing these holdings offers valuable insights into the fund manager’s investment strategy and the primary drivers of the fund’s performance. It is essential to assess the concentration risk by checking whether a significant portion of the fund’s assets is invested in a few securities or spread across multiple investments.

Diversification is a fundamental principle in mutual fund investing. A diversified fund reduces the impact of poor performance from any single investment, thereby stabilizing returns and managing risk. Investors should look for funds that balance diversification with focused investment strategies that align with their financial objectives.

Accessing and interpreting fund portfolio information is straightforward with the right resources. Mutual fund companies typically provide detailed portfolio reports on their websites, including fact sheets and quarterly updates. Financial news platforms and investment research websites also offer comprehensive portfolio analysis tools. Key metrics to review include the fund’s expense ratio, turnover rate, and historical performance data.

In summary, a thorough analysis of a mutual fund’s portfolio is indispensable for making informed investment decisions. By carefully evaluating asset and sector allocations, top holdings, and diversification strategies, investors can select funds that align with their risk tolerance and financial goals.

Understanding Fees and Expenses

When selecting mutual funds, it is crucial to comprehend the array of fees and expenses that can impact your investment returns. These costs can significantly erode your profits over time, making it essential to understand their implications fully. One of the primary costs to consider is the expense ratio, which represents the annual fee that all mutual fund shareholders pay. This fee covers the fund’s operating expenses, including management fees, administrative costs, and other miscellaneous expenses. An investor should note that even a seemingly small difference in expense ratios can lead to substantial variations in long-term returns.

Management fees are another critical component of mutual fund expenses. These fees are paid to the fund’s investment advisor for managing the fund’s portfolio. Typically, they are expressed as a percentage of the fund’s average assets under management. Higher management fees do not necessarily equate to better performance, so investors need to evaluate whether the fund’s returns justify the fee.

Load fees are charges paid when you buy or sell mutual fund shares. Front-end load fees are paid when purchasing shares, reducing the amount of your initial investment. Conversely, back-end load fees, or deferred sales charges, are paid when shares are sold. These fees can be a significant cost to investors, especially if the investment is held for a shorter period. It is advisable to consider no-load funds, which do not charge these fees.

There are also other hidden costs, such as 12b-1 fees used for marketing and distribution, and trading costs incurred when the fund manager buys and sells securities within the fund. These can sometimes be overlooked but are essential in the overall cost structure of the mutual fund.

To make informed decisions, investors should carefully review the fee structures of different mutual funds. Comparing the expense ratios, management fees, and load fees across various funds will provide a clearer picture of the total cost involved. By understanding these fees and expenses, investors can choose mutual funds that align with their financial goals while minimizing unnecessary costs.

Evaluating Fund Management

When selecting mutual funds, evaluating the fund management team is a crucial step. The success of a mutual fund often hinges on the expertise and decisions of its fund managers. Their experience, investment philosophy, and track record play a significant role in driving the fund’s performance. It’s essential to scrutinize these elements to ensure that your investment is in capable hands.

Firstly, the experience of the fund manager is paramount. Managers with a long history in the industry have often weathered various market conditions and have a deeper understanding of investment strategies. They are likely to have developed a keen sense of timing and risk management, which can be beneficial in navigating market volatility. Look for managers with a proven track record spanning multiple market cycles.

Secondly, understanding the investment philosophy of the fund manager is essential. This philosophy dictates how they make investment decisions and manage the fund’s portfolio. Some managers may adopt a value-oriented approach, seeking undervalued stocks, while others might prefer growth strategies, targeting companies with high growth potential. Ensure that the manager’s philosophy aligns with your investment goals and risk tolerance.

Researching and evaluating fund management teams involves examining their past performance. A strong track record of consistent returns, especially during turbulent market periods, is a positive indicator. It’s important to analyze performance over a minimum of five to ten years to get a comprehensive view. Furthermore, consider the manager’s tenure with the fund. A long tenure suggests stability and a deeper commitment to the fund’s success.

Lastly, look for transparency and communication from the fund management team. Managers who regularly update investors on the fund’s performance, strategy adjustments, and market outlook demonstrate accountability and openness. This transparency fosters trust and provides investors with insights into the decision-making process behind their investments.

In conclusion, the role of fund management in the success of mutual funds cannot be overstated. By thoroughly evaluating the experience, investment philosophy, and track record of fund managers, investors can make informed decisions and choose mutual funds that align with their financial objectives.

Making the Final Decision

Finalizing your mutual fund choices involves a well-thought-out process that integrates the various elements discussed in previous sections. Initially, it’s crucial to have a clear understanding of your financial goals, risk tolerance, and investment horizon. With these parameters defined, you can narrow down the types of mutual funds that best align with your objectives. For instance, growth-oriented investors might lean towards equity funds, while those seeking stability might prefer bond or balanced funds.

Once you’ve identified the types of mutual funds suitable for your needs, the next step is to evaluate individual funds within those categories. Key factors to consider include the fund’s historical performance, expense ratios, and the credentials of the fund manager. Comparing these elements across different funds can provide a clearer picture of their potential effectiveness in meeting your financial goals.

Diversification is paramount when creating a mutual fund portfolio. Spreading your investments across various asset classes and sectors can mitigate risks and enhance returns. A diversified portfolio typically includes a mix of domestic and international stocks, bonds, and possibly alternative investments, depending on your risk tolerance and investment strategy.

After assembling your portfolio, it’s important to review and rebalance it regularly. Market conditions and personal financial goals can change, and your portfolio should reflect these shifts. Periodic rebalancing ensures that your asset allocation remains aligned with your initial objectives, thereby maintaining the risk-return profile you envisioned.

Practical tips for rebalancing include setting a regular review schedule—quarterly or annually—and adhering to it. Utilizing tools and resources provided by your financial advisor or brokerage can also simplify the rebalancing process. Additionally, staying informed about market trends and economic indicators can provide valuable insights for making timely adjustments to your portfolio.

By following these steps, you can make informed decisions that optimize your mutual fund investments, ensuring they continue to support your financial goals effectively.