Introduction to Investment Strategies

Embarking on the journey of investing can be a pivotal moment in one’s financial life, especially for beginners. A robust investment strategy serves as the foundation for achieving long-term financial goals and ensuring financial stability. The significance of starting early cannot be overstated; the earlier one begins investing, the more time there is to benefit from the power of compound interest. This exponential growth mechanism allows investments to generate earnings, which are then reinvested to produce their own earnings, creating a snowball effect over time.

Understanding one’s risk tolerance is another crucial element in formulating an effective investment strategy. Risk tolerance refers to an individual’s willingness and ability to endure market volatility and potential losses. By assessing their risk tolerance, investors can select investments that align with their comfort level, thereby reducing the likelihood of emotional decisions driven by market fluctuations.

Setting clear financial goals is essential for guiding investment decisions. Whether the objective is to save for retirement, purchase a home, or fund an education, having specific targets helps in creating a focused and disciplined investment plan. These goals also provide a benchmark for measuring progress and making necessary adjustments along the way.

Diversification is a key principle in mitigating risk and enhancing potential returns. By spreading investments across a variety of asset classes, such as stocks, bonds, and real estate, investors can reduce the impact of poor performance from any single investment. This approach ensures that the portfolio is not overly reliant on one type of asset, thereby providing a more balanced risk-reward profile.

In summary, a solid investment strategy is indispensable for beginners. It involves starting early, understanding risk tolerance, setting financial goals, and maintaining a diversified portfolio. By adhering to these fundamental principles, novice investors can navigate the complexities of the financial markets with greater confidence and build a foundation for long-term success.

1. Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy where investors consistently invest a fixed amount of money at regular intervals, regardless of market conditions. This method is particularly beneficial for beginners, as it helps to mitigate the impact of market volatility. By investing a set amount regularly, investors purchase more shares when prices are low and fewer shares when prices are high, averaging out the cost per share over time.

One of the key advantages of dollar-cost averaging is its potential to reduce the emotional impact of market swings. Investors who employ this strategy are less likely to make impulsive decisions based on short-term market fluctuations, as their investment plan is already set. This structured approach encourages discipline and long-term thinking, which are crucial elements of successful investing.

For example, consider an investor who decides to invest $200 every month in a mutual fund. In a month where the share price is $20, they purchase 10 shares. If the following month the price drops to $10, they buy 20 shares. Over time, this strategy can lower the average cost per share, potentially leading to higher returns when the market eventually rises.

Another significant benefit of DCA is its simplicity. Beginners often find the stock market intimidating due to its complexity and unpredictability. Dollar-cost averaging simplifies the process by requiring only a consistent investment schedule, making it an ideal starting point for new investors. Additionally, it ensures that investors remain active in the market without the need to time their investments perfectly.

Overall, dollar-cost averaging is a prudent strategy for those new to investing. It provides a structured approach to investing that can help manage risk, reduce emotional stress, and build wealth over time. By committing to regular investments, beginners can steadily grow their portfolios while navigating the ups and downs of the market.

2. Diversification

Diversification is an essential strategy for managing risk in an investment portfolio. By spreading investments across various asset classes, sectors, and geographic regions, investors can minimize the potential for significant losses. The fundamental principle of diversification is to avoid putting all your eggs in one basket. This involves allocating investments among different types of assets such as stocks, bonds, real estate, and commodities. Each asset class behaves differently under various market conditions, which can help balance the overall performance of the portfolio.

For example, an investor might allocate 40% of their portfolio to stocks, 30% to bonds, 20% to real estate, and 10% to commodities. Within these categories, further diversification can be achieved by investing in different sectors. In the stock portion, one might invest in technology, healthcare, and consumer goods companies. Geographical diversification can involve investing in both domestic and international markets, thereby spreading geopolitical risks and taking advantage of growth opportunities in different regions.

Asset allocation is a critical component of diversification. It involves determining the right mix of assets based on an investor’s risk tolerance, investment goals, and time horizon. A well-diversified portfolio typically includes a blend of high-risk, high-reward investments and more stable, lower-risk securities. This balance helps to cushion the impact of market volatility and can lead to more consistent returns over time.

However, beginners often make common mistakes when trying to diversify. One such mistake is over-diversification, where the portfolio contains too many investments, diluting potential gains. Another error is under-diversification, where the portfolio is not sufficiently spread out, leaving it vulnerable to market fluctuations. Additionally, some investors might mistakenly believe that owning multiple stocks within the same sector constitutes diversification, which does not protect against sector-specific downturns.

To avoid these pitfalls, it is crucial to conduct thorough research and, if necessary, seek advice from financial professionals. Proper diversification requires a strategic approach, balancing various factors to build a resilient and growth-oriented investment portfolio.

Investing in Index Funds

Index funds are mutual funds or exchange-traded funds (ETFs) designed to replicate the performance of a specific market index, such as the S&P 500. For beginners, these funds are an attractive option due to their low costs, simplicity, and the broad market exposure they offer. By investing in index funds, individuals gain access to a diversified portfolio that tracks the performance of a broad segment of the market.

One of the primary benefits of investing in index funds is their cost efficiency. Unlike actively managed funds, which require fund managers to select stocks, index funds are passively managed. This results in lower management fees and operational costs. Over time, these cost savings can significantly boost overall returns, making index funds a prudent choice for long-term investors.

Furthermore, index funds offer broad market exposure, which helps mitigate the risk associated with investing in individual stocks. By tracking an entire index, these funds inherently diversify investments across various sectors and companies. This diversification reduces the impact of poor performance from any single stock, thereby enhancing portfolio stability.

The passive management style of index funds is another notable advantage. Since these funds aim to mirror the performance of a specific index, there is no need for frequent buying and selling of stocks. This approach minimizes transaction costs and reduces the potential for human error in stock selection. Over the long term, passive management has been shown to outperform many actively managed funds, making it an effective strategy for beginners.

When choosing the right index fund, investors should consider factors such as the fund’s expense ratio, the index it tracks, and the fund’s historical performance. It is also crucial to be aware of potential pitfalls, such as tracking errors, which occur when the fund’s performance deviates from the index it aims to replicate. Additionally, investors should be mindful of market conditions and ensure they have a long-term investment horizon to ride out any market volatility.

Overall, investing in index funds offers a straightforward and cost-effective way to build a diversified investment portfolio, making it an ideal strategy for beginners seeking steady, long-term growth.

4. Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans (DRIPs) present a compelling investment strategy for beginners by allowing investors to reinvest their dividends to acquire additional shares of the stock, often without incurring commission fees. This mechanism not only facilitates cost-effective investment but also leverages the power of compound growth to build wealth over time.

DRIPs operate by automatically reinvesting the cash dividends paid out by a company into more shares of that company’s stock. This automated process enables investors to gradually increase their holdings without the need to manually purchase additional shares. The beauty of this strategy lies in its simplicity and the benefits of compounding. As the number of shares increases, so does the potential for future dividends, creating a snowball effect that can significantly enhance portfolio value over the long term.

Setting up a DRIP is relatively straightforward. Investors can enroll through the company’s investor relations department or their brokerage firm if the service is offered. Many major companies, including Coca-Cola, Johnson & Johnson, and Procter & Gamble, provide DRIP options, making it easy for beginners to start investing and growing their portfolios.

However, there are important tax considerations to keep in mind. Dividends reinvested through DRIPs are still considered taxable income, even though they are not received as cash. Consequently, investors need to account for these dividends in their annual tax filings. It’s advisable to maintain good records of all reinvested dividends to simplify tax reporting.

While DRIPs offer numerous advantages, there are potential drawbacks. For instance, the reinvestment process may result in fractional shares, which can complicate the calculation of an overall investment’s value. Additionally, some companies may not offer DRIPs, limiting the availability of this strategy.

Overall, DRIPs provide a practical and efficient method for beginners to grow their wealth over time, harnessing the power of compound growth and minimizing investment costs. By understanding how DRIPs function, the benefits they offer, and their potential limitations, investors can make informed decisions that align with their financial goals.

5. Robo-Advisors

Robo-advisors are increasingly becoming popular tools in the investment landscape, particularly among beginners. These automated platforms provide financial advice and manage investments with minimal human intervention. The core functionality of robo-advisors relies on sophisticated algorithms designed to create and manage a diversified portfolio tailored to an individual’s risk profile and financial goals.

When you sign up with a robo-advisor, you typically start by answering a series of questions about your financial situation, investment goals, and risk tolerance. Based on your responses, the robo-advisor’s algorithm generates a customized portfolio. This portfolio is often diversified across various asset classes, such as stocks and bonds, to optimize returns while managing risk. The algorithm continually monitors and rebalances the portfolio to maintain the desired asset allocation.

One of the most appealing advantages of robo-advisors is their cost-effectiveness. Traditional financial advisors often charge high fees, which can eat into investment returns. In contrast, robo-advisors usually charge significantly lower fees, making them an attractive option for new investors who may not have substantial capital to invest. Additionally, the user-friendly interfaces of these platforms make them accessible even to those with little to no investment experience.

Despite their benefits, robo-advisors are not without limitations. For instance, while they are excellent for creating and managing a diversified portfolio, they may not offer the personalized financial planning services that a human advisor can provide. Complex financial situations, such as estate planning or tax strategy, might still require human expertise. Furthermore, the reliance on algorithms means that robo-advisors may not always be able to respond to market anomalies or sudden financial crises with the same nuance a human advisor might.

Overall, robo-advisors represent a significant advancement in making investment management accessible and affordable for beginners. They offer a blend of technology and financial acumen that can effectively guide novice investors toward achieving their financial goals while keeping costs low and simplifying the investment process.

Common Mistakes to Avoid

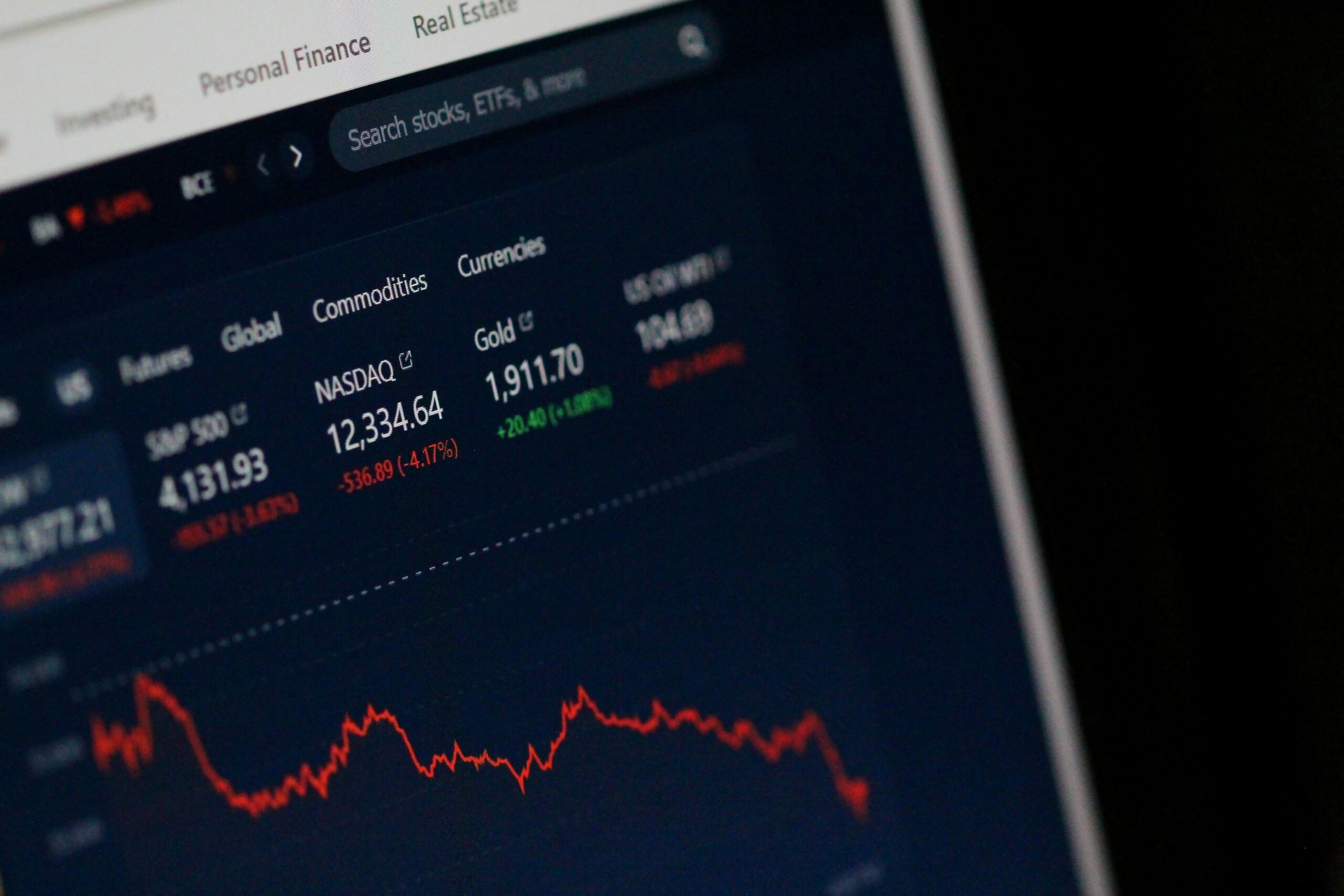

Investing can be a rewarding endeavor, but beginners often fall into certain traps that can hinder their progress. One of the most prevalent mistakes is attempting to time the market. Market timing involves trying to predict when prices will rise or fall, a notoriously difficult feat even for seasoned investors. Instead of attempting to time the market, it’s more prudent to adopt a long-term perspective and remain consistent with your investment strategy.

Another common pitfall is insufficient research. Investing without thorough research can be likened to gambling. Before committing to any investment, it’s crucial to understand the underlying asset, its market potential, and associated risks. Utilize reputable sources and consider professional advice to make informed decisions.

Overtrading is yet another mistake that can erode potential gains. Overtrading occurs when investors frequently buy and sell assets, often driven by short-term market movements. This behavior can lead to increased transaction costs and tax liabilities, ultimately reducing overall returns. A more effective approach is to create a well-diversified portfolio and stick to it, making adjustments only when necessary based on significant changes in personal financial goals or market conditions.

Emotional decision-making can also derail a well-thought-out investment plan. Fear and greed are powerful emotions that can lead to impulsive actions, such as panic selling during market downturns or overcommitting during bullish phases. To mitigate emotional influences, establish a clear investment plan and adhere to it. Setting predefined rules for buying and selling can help maintain discipline and reduce the impact of emotional decision-making.

Ultimately, the key to successful investing lies in staying disciplined and patient. Avoiding these common mistakes can enhance your ability to achieve long-term financial goals. By focusing on a well-researched, long-term strategy and resisting the temptation to make impulsive moves, you can cultivate a more stable and rewarding investment journey.

Conclusion and Next Steps

Embarking on your investment journey can be both exciting and daunting. As discussed in this blog post, having a well-thought-out investment strategy is crucial for success. By understanding and implementing the top five investment strategies, beginners can build a solid foundation for their financial future. These strategies include diversifying your portfolio, investing for the long-term, understanding risk tolerance, regularly reviewing your investments, and continuously educating yourself about market trends and financial principles.

To get started, it’s essential to take actionable steps. Begin by setting up an investment account with a reputable brokerage firm. Many platforms offer user-friendly interfaces and educational resources tailored for beginners. Start with small investments to familiarize yourself with the process and gradually increase your contributions as you gain confidence and knowledge.

Continuous education is another critical component of a successful investment strategy. Stay informed about market developments, economic indicators, and emerging investment opportunities. Utilize resources such as financial news websites, investment books, and online courses to enhance your understanding. Joining investment forums or groups can also provide valuable insights and support from fellow investors.

While self-education is important, don’t hesitate to seek professional advice when needed. Financial advisors can offer personalized guidance based on your individual goals, risk tolerance, and financial situation. They can help you develop a tailored investment plan and provide ongoing support to ensure you stay on track.

Finally, remain committed to your financial goals and be patient. Investing is a long-term endeavor, and it’s important to stay focused on your objectives even during market fluctuations. Regularly review your investment portfolio and make adjustments as necessary to align with your evolving goals and risk tolerance.

By taking these steps, beginners can confidently navigate the world of investing and work towards achieving their financial aspirations. With a solid strategy, continuous learning, and professional guidance, the path to financial success becomes much clearer and attainable.